Forex Trading

Trade the world’s largest financial market with spreads from as low as 0 pips

Learn how to trade forex

Currency prices are constantly moving offering numerous trading opportunities on a daily basis. In forex, currencies are listed in pairs, e.g. EUR/USD, GBP/USD, USD/JPY. Unlike the price of commodities and shares, the forex market neither goes up nor down. What really happens is that the price of one currency moves up or down in relation to another.

The most common terms in forex trading are buy and sell, or going long and short. However, when you trade forex online, you are neither buying nor selling real currency. All you do is placing a bet on the direction in which a currency pair will move.

The amount of money made or lost on a trade depends on the market move and the size of your position. At AS-HOM GLOBAL, you can trade major, minor and exotic forex pairs with no minimum deposit requirement for a Standard account and just $200 for a AS-HOM GLOBAL account and up to 1:400 leverage.

of our traders have also tried trading Gold

Trading Forex on AS-HOM

Find high probability trades and recommended target & stop loss levels with our powerful risk management tool.

No more missed opportunities. Get notified across all your devices when key market movements take place.

Trading Forex with AS-HOM

Here’s why thousands of traders around the world choose to trade Forex with us.

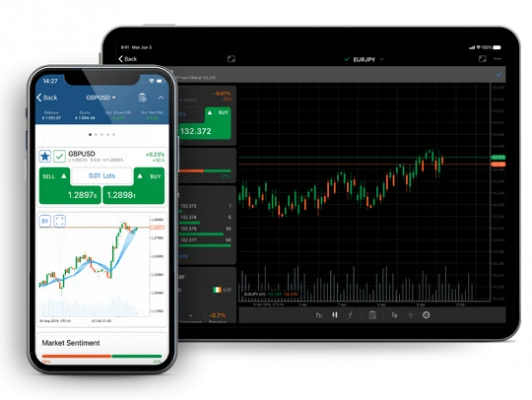

Innovative platform

Our cutting-edge AS-HOM platform is the platform that best meets your needs.

World-class support

Our multi-lingual support team is here to assist you with all your questions 24 hours a day, 7 days a week via email, telephone, and live chat.

How Forex Trading Works?

In forex, currencies are quoted in pairs. Let’s take the most popular currency pair as an example, EUR/USD. The first currency (Euro in this case) is called the base currency and the second (USD) is called the quote currency. When you trade a pair you are speculating on whether the base currency (EUR) will strengthen or weaken against the quote currency (USD).

Forex prices are typically quoted to five decimal places. The most important decimal point to keep an eye on is the fourth, also known as pip. It is the number of pips we use to calculate the profit and loss.

Forex positions are traded in specific amounts called lots, which equals to 100,000 units of the base currency. It is also possible to trade in smaller amounts – mini, micro and nano lots sizes, corresponding to 10,000, 1,000 and 100 units respectively.

What influences forex prices?

There are three key factors that impact the prices in the forex market.

- Financial newsEconomic reports have a big effect on currencies. For that reason, the Economic Calendar is the trader’s best friend. It includes all scheduled news events and data releases, graded by importance.

- Political instabilityCurrencies are sensitive to political uncertainty caused by events such as elections, referendums and political scandals.

- Natural disastersActs of God, such as tsunamis, earthquakes and hurricanes, can cause significant price volatility in the currency associated with that region.

Who Trades Forex?

Apart from banks, financial companies and professional traders, anybody with an interest to capitalize on daily market moves can access currency trading. Forex is often described as a decentralised global market. What that means is that there is no physical location where traders meet to buy or sell.

In such a market, it is technology that makes it possible for traders all over the world to deal directly with each other. Put simply, forex is a market without middlemen. All you need to participate in this fascinating and fast paced market too is a trading account with a reliable broker.

Advantages of Forex Trading

Forex trading has evolved into one of the most popular markets to trade. Here are the three key reasons why so many traders choose it.

- Available 24 hoursFrom Sunday to Friday evening, the forex market is available for trading around the clock. This makes it ideal for traders who can only trade the markets on a part-time basis.

- LeverageWhen trading forex online, you can control positions much larger than your capital by using leverage. This can lead both to larger gains and losses, which makes risk management a key part of every forex trading strategy. At , you can choose to trade currencies with leverage up to 1:400.

- Low starting capitalUnlike trading on an exchange where the contract sizes are predetermined, when trading forex online, you get to decide the size of your positions. This allows traders to start with the capital they feel comfortable with. At AS-HOM GLOBAL, you can start participating in the fascinating currency markets with no minimum deposit requirement for a Standard account and only $200 minimum deposit for a AS-HOM GLOBAL.