Why trade indices?

Discover why traders around the world choose indices for their trading success.

Trading indices – The basics

With indices like DAX and Dow Jones making headlines every day in the financial world, what exactly are indices and how can traders benefit from adding them to their trades? Let’s start with the basics. An index, also known as a stock market index, is a measure of a group of companies and is used to evaluate the performance of a sector, region, or national economy.

The first index was created in 1885 by Charles Dow, editor of the Wall Street Journal and co-founder of Dow Jones & Company. Before the digital age, the price of an index was calculated using a simple average that added up the prices of its components divided by the number of companies.

Market-value-weighted vs. price-weighted indices

Market-value-weighted vs. price-weighted indices

Today indices use different formulas to determine their price, which can be divided into two main categories, which is key for traders to understand before evaluating the performance of an index.

1. Market-value-weighted indices

Market-weighted indices are calculated based on the total market value of its constituent companies. This means, the bigger the company, the larger the impact it has on the index. This is the most common methodology used by indices, with FTSE and DAX being classic examples.

2. Price-weighted indices

This type of indices are calculated based on its companies’ share price. In this case, constituent companies with higher share prices have a bigger impact on the overall index than companies with a lower price.

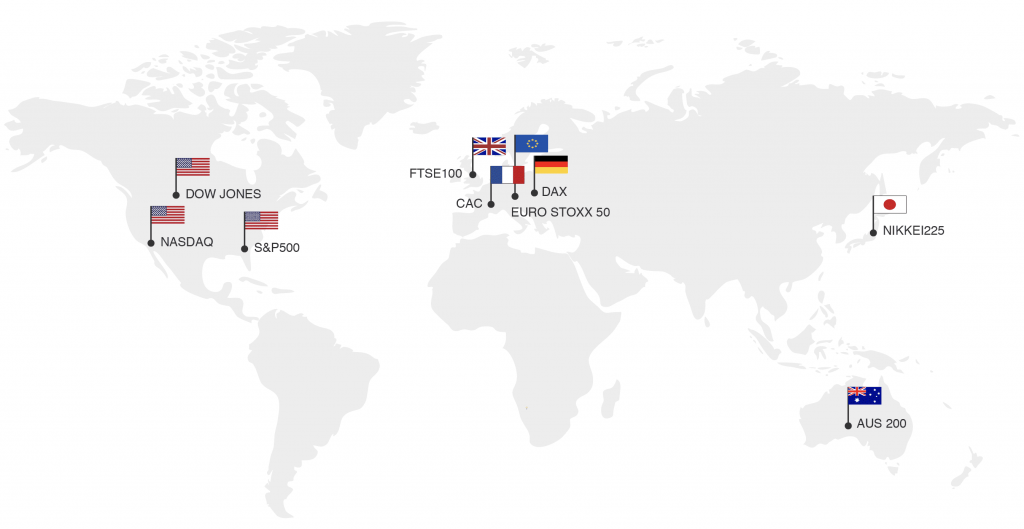

Top 9 Global Indices

Are You Ready To Trade Indices Live?

Major Indices Explained

About Forex

UK100

This key index is comprised of 30 large, publicly traded companies in the US. Since it is price-weighted, the companies with larger share prices would have greater impact over its value.

GER30

Also known as the DAX stock index, it contains the 30 top German companies based on market capitalization. The DAX is among the most traded indices around the world due to consistently higher volatility and higher daily ranges than other indices.

SPX500

The SPX500, also known as the S&P 500, is without doubt the most widely known index in the world. It was created by the publishing firm Standard & Poor’s and includes the top 500 American companies. Due to its strong correlation with other markets, the S&P500 is a popular choice among traders.

US 30

The US 30, or most commonly known as the Dow, is the most recognizable stock index in the world, tracking the stocks of 30 companies in nine core market sectors. A unique feature of this index is that it is a price-weighted average and its movements are used as an indicator to gauge risk sentiment around the world.

NASDAQ

The NASDAQ is an American index best known for representing the technology sector. Although it includes a number of other sectors too, names like Apple, Facebook and Google headline its constituents.

JPN225

Also known as the Nikkei 225, this is the most popular index in the Tokyo Stock Exchange and a key indicator for the performance of the Japanese economy. Considering that Japan is an export-oriented economy, it is no wonder that Nikkei225 is highly correlated to the US stock markets.

AUS200

AUS200, more commonly known as ASX200, is a stock market index that includes 200 of the biggest companies in Australia. It is a capitalization-weighted index, meaning company contributions to the index are based on its total market value.

FRA40

FRA 40, also known as CAC, is the benchmark index of the French stock market. Considering that France is one the major economies in Europe, it is widely used to assess the health of Europe as a whole. Some of the most famous constituents include L’Oreal, AXA and Michelin.

ESTX50

ESTX50, or Euro Stoxx 50, consist of Europe’s 50 leading companies and is often referred to as the European Dow Jones. This is a market weighted index, with its constituents reviewed on an annual basis every September.